5 reasons why you should outsource your accounting

1. Free up time to work on your product or service

You didn’t start your own business to be your own accountant. Let us manage your bookkeeping, payroll, sales tax, bill payments, and document storage. After all, this is exactly why we started our own business! As an entrepreneur your time is best spent on growing the business and bringing in new customers

There comes a time in every business where owners need more than just financial accounting for compliance and tax filing purposes. These business owners need management accounting. These businesses matured to the point where they need to know their key performance indicators in order to make real time decisions.

2. You Outgrew Bookkeeping Services

Questions you ask when you outgrow bookkeeping services:

1. Is my pricing right?

2. Who are my most profitable clients?

3. How do I compare to my peers?

4. Where should I invest in my business?

5. Should I hire (or fire) an employee?

6. Am I paying too much in taxes and is there anything I can do to reduce it legally?

Trigger point:

a) Reaching $1,000,000 in annual revenue

b) Hiring at least 6 employees

c) You need more than just a part time bookkeeper but you don’t need a full time CPA or CFO either

d) You’ve made a large tax mistake before costing you unnecessary interest and penalties

e) A former vendor or employee successfully defrauded your business

3. Outsourcing the accounting function is more efficient and cost effective

Hiring an additional full time employee dedicated as a bookkeeper can be a huge cash drain on your business. Not only is a dedicated employee cost prohibitive but worst of all it would mean that the task is just getting the attention it need. No one person can know all the tax breaks available to businesses or defend them in case of an audit. Having a team based approach can ensure that there are several sets of eyes overlooking your books and records. In addition, by only using the services when you need them, your firm can greatly reduce the administrative cost of a full time in house bookkeeper.

4. Reduced potential for fraud

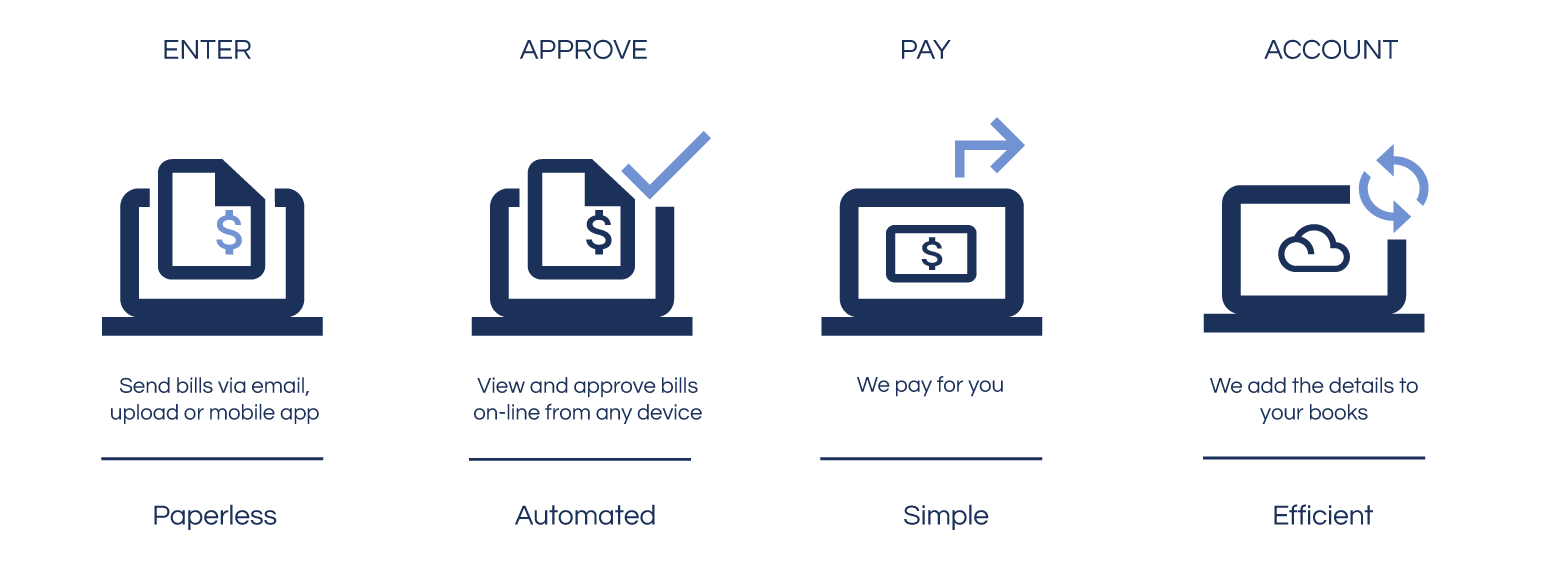

Giving one person the responsibility to enter, approve, and pay bills can lead to the perfect opportunity for fraud. Separating these functions were not easy to carryout. Until now, Businesses had to pick between minimizing fraud exposure or take a hit on efficiency when paying bills. Imagine, having one person enter bills, then someone else approve the bill and print the checks, and finally a 3rd person would sign the check. This would be a nightmare for any business to logistically manage. Worst of all, bill pay often meant that your vendors received checks/ACH payments from you with your bank routing and account number exposed. With our solution we pay bills using a 3rd party provider. This ensures your checking account numbers/routing numbers remain secure. Finally, efficiency and security built into one cloud solution.

Our Workflow For Bill Pay

5. We are the Accountants

(and the tax advisors)

As a full service, accounting, tax, and advisory firm, we deal with the tax code every day. We know it forwards and backwards. We know what to look for and we know where to look to find answers for our clients. Since our clients come from all types of industries other than accounting/ tax many wouldn’t be able to access the quality of the professional working on their account. Because of our subject matter expertise, we can vet the quality of our staff to ensure they have the knowledge to effectively fulfill your accounting needs.