Accounting, Controller, & CFO Service Packages.

Our Service Packages oversee your Company’s Accounting, Payroll, and Tax Returns. With our outsourced Accounting services, you get a package of compliance services to help with the basics of your everyday accounting and tax needs as well as the most common advisory services most small business are in need of.

These Services Include:

Monthly Bookkeeping

Payroll Setup & Management

Income Tax Filing

Estimated Tax calculations

Bill Pay Management

(Accounts Payable Services)Document Management System (Bills, Receipts, Check Images, Bank Statements)

Preparation & Filing of form 1099-MISC

Tax Reduction Strategies

Audit Defense & Representation

Employee Expenses Reimbursement

Unlimited Phone & Email Support

Professionals You Need To Run a Successful Business

Bookkeeper

Record supplier/vendor invoices in the accounting system

Pay supplier/vendor invoices on time and record payments in the . accounting system

Run and record payroll in the accounting system

Record sales and keep track of deposits

Reconcile company bank/credit card accounts Maintain company records for tax filing

Tax Accountant

Use company prepared records to file income/sales/payroll taxes

Review and approve tax payments/refunds

Take advantage of tax minimizing strategies

Ensure that company documents are maintained in case of an audit

Tax Accountants implement and maintain tax strategy

Produce financial reports for external use

CFO

Oversee functions of both the tax accountant and Bookkeepers

Ensure compliance and maintain company insurance policies to manage risk

Develop growth strategy to scale business

Measure and improve profitability

Assist in raising capital and reviewing loan documents

Create projections and forecasts for management

Tailor Made Service Packages

No matter the plan you choose, we are committed to delivering the clarity and peace of mind you would expect from a professional accounting firm. We are your local, trusted, tax and financial partner. Please feel free to reach out to us if you would like us to customize a service package to better fit you needs.

Benefits of our Accounting / Controller /

CFO Services

Have Audit-Ready Financials/Books Available Anywhere A Controller can oversee your entire accounting function and acts as the head of your accounting department. Controllers ensure that your records are up to date and are easily accessible. Common ways in which a controller can help your business include:

Maintain an accurate list of bills outstanding

Maintain an electronic paper trail of receipts, bills, and checks to defend in case of a tax audit

Acts as the Liaison for all communications between the tax authorities and your business

Benchmarking and comparing your business performance to your peers

Understand your Key Performance Indicators (KPI’s)

As a business owner, you have a vision and a passion. You probably didn’t get into business for yourself to handle your accounting and financial metrics. A part-time Controller goes beyond reviewing just your financial statements. A Controller can help you understand key financial information about your business, including:

Break-even Point

Margin of Safety

Profit-per-Project

Cash flow Analysis

Revenue-per-Employee

Monthly Sales Growth

Our Services can help your business with its most common issues such as:

Managing receivable/payable policies of the firms

Review of potential savings from the use of new technologies available in the market

Deploying a consistent budget available for marketing to sustain your pipeline and normalize revenue

Evaluate Major purchase decisions

Evaluate the viability of new business opportunities

Review financing options available and structuring them to accommodate cash flow needs

Act as the “right-hand” person to you or your CFO

Having your financial statements prepared, reviewed, and maintained by a Controller can ensure that you or your CFO have the right financial data to make informed business decisions about how to grow your business. Without the right information, businesses owners are not able to answer key questions on when they should:

Hire (or fire) employees

Grow through acquisition (inorganically)

Grow organically through the opening of additional locations

Obtain credit from a bank Benchmark your performance to that of your peers

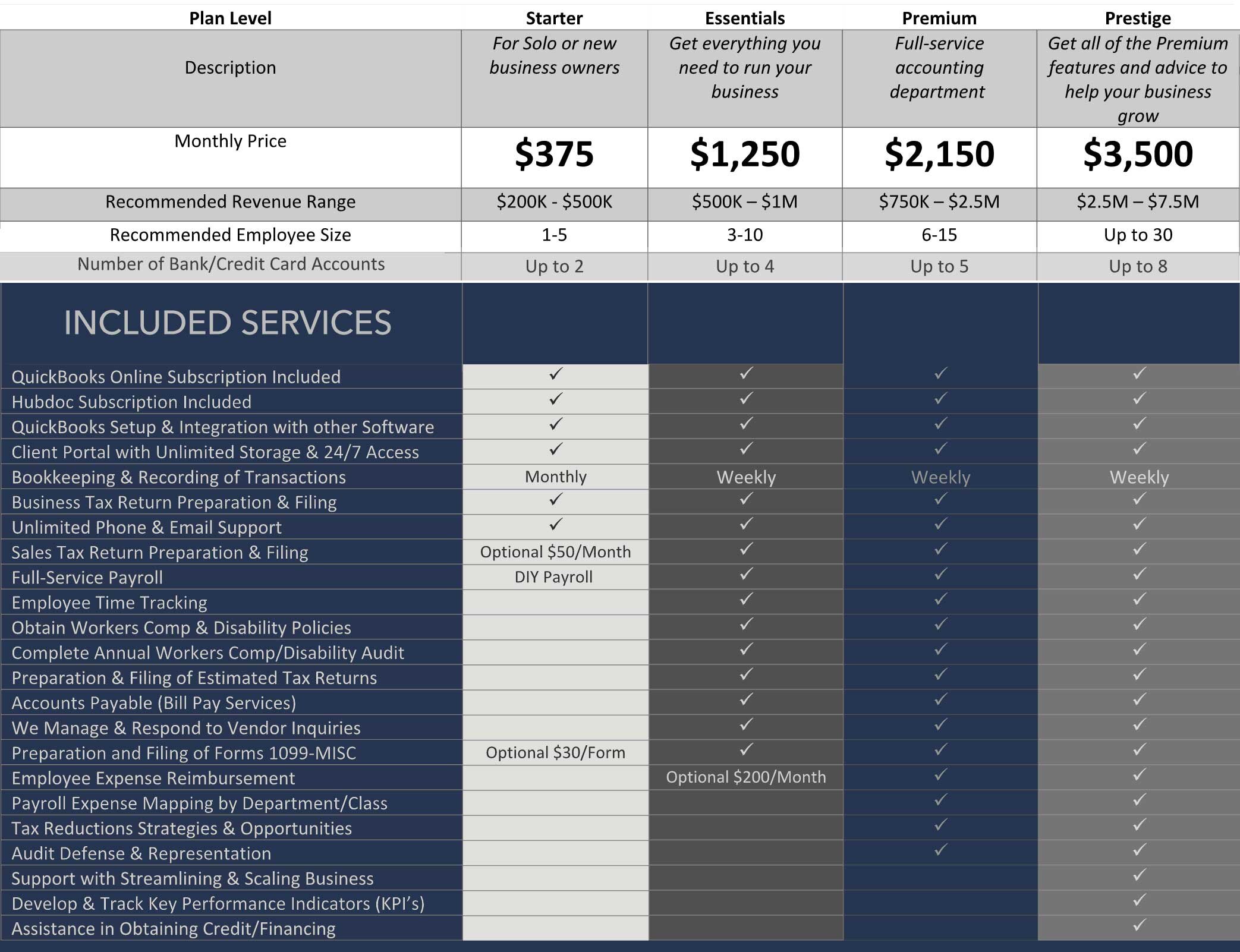

ACCOUNTING PLANS